6 Steps You Can Take TODAY To Improve Your Credit Score

We hope you all had a wonderful Thanksgiving weekend! We spent the last few days relaxing with family, enjoying the best food + doing a little too much online shopping! Lately, we’ve received so many questions from readers all about credit. From whether or not it’s okay to close credit cards, how many cards is too many or what really goes into a credit score, there is so much that you all want to know!

A few years ago, we wrote a post answering all of these questions, a Credit 101 guide if you will + we wanted to share it again! A refresher for those who have followed us for a while + a new read for those who are just joining us!

Without further ado…

As human beings, we seek trust in every interaction that we have. Whether it be our politicians, our significant others or our coffee shops, we choose what we can trust + what we believe in.

In much the same way, banks, lenders and financial stakeholders choose customers that they can trust and rely on. How? By your credit score, or what the overachieving nerd in me likes to think of as the only grade that matters once you finish school. Your credit score allows a lender to determine how financially responsible and reliable you are before he or she ever meets you in person. Understanding your credit score is one of the most important things you can do for your financial well-being, as building a good credit score has the power to save you hundreds of thousands of dollars over the course of your lifetime.

Ironically, while a credit score is one of the most vital factors in building long-term wealth, it is, often, the most overlooked, simply, because it is hard to wrap our minds around. As a personal finance freak, I have put in the hard, and painfully boring, work to understand credit scores, so that you don't have to. First, not sure what your credit score is? To find out for free, go to Credit Karma. Next, you will want to obtain a free credit report, which details exactly why you received the score that you did, go to Annual Credit Report. You are entitled to one free credit report each year without damaging your credit. Contrary to popular belief, you are entitled to unlimited credit score checks each year. I like to check mine once a month because I get a strange satisfaction watching the number creep up, even by just one point. If you are a normal human being, however, checking your score three times a year, about once every four months, is just right.

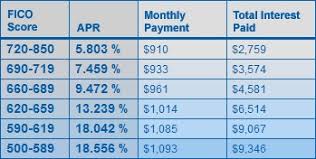

Once you have determined your credit score, use the table below to determine the strength of your score and just how reliable you will appear to potential lenders.

To illustrate just how powerful an excellent credit score can be...

This table is one of the many reasons why I stress to my peers the importance of paying attention to the big picture in personal finance, rather than small choices like skipping Happy Hour. It's fine to be frugal and, in many ways, admirable, but you should focus on the big wins, the things that truly matter, first. If you have a poor credit score, there is no amount of missed cocktails that will bridge the gap.

Whether you are thrilled with your score or looking to increase a low score, it pays (literally) to answer two important questions.

1) What went into this score?

Even if you have a perfect credit score (congratulations, by the way!), it is important to understand why you earned it, so that you can take the right steps to maintain it. I can't tell you how many times I have heard friends exclaim "Well, I don't make very much, so my credit score is terrible" or "I open a credit card everywhere I shop so that I can boost my credit score." Both of these statements are so far from the truth. Your credit score is comprised of five things and none of these five are your income. In fact, you or I could have a better credit score than Beyonce or Bill Gates which, in my opinion, is pretty cool. Without further ado, below are the five components that your credit score is based upon:

Payment History - 35%. Late or missed payments hurt you and have the greatest impact on your score. Believe it or not, this includes parking tickets!

Credit Utilization Rate - 30%. Potentially confusing term, but this simply shows the percentage of your available credit that you are using. For example, if you have a $5000 credit limit and a $1000 balance, you have a credit utilization rate of 20%. A high credit utilization rate suggests to potential lenders that you may be desperate for more credit or financially unstable, as you are spending a lot of money that you don't have. It is best to use less than 30% of your available credit, as it shows that you know how to use credit wisely. Therefore, if you have a $10,000 limit, aim to have no more than $3000 outstanding at any given time.

Length of History - 15%. This shows how long your accounts have been open. For young people, this can be the most challenging component of your score to improve. Many people choose to tag onto their parent's credit history and become an authorized card holder on a parent's account. Be very cautious if you choose to do so. While your parents may have a longer credit history, if they miss a payment or run a high balance, it will negatively affect your score. My advice: be patient. If you are responsible with your credit in general, this score will naturally improve over time and lenders will understand this.

New credit - 10%. This shows how many recent inquiries have been made on your credit, as well as what percentage of your open accounts are new or recently opened. An inquiry is made on your credit every time you sign a lease on an apartment, open a new credit card, apply for a mortgage and a multitude of other scenarios. It is best to keep inquires to a minimum, no more than 2 to 3 a year.

Types of credit - 10%. It is best to have varied types of credit, such as 1 student loan, 1 mortgage and 1 credit card versus 3 credit cards.

2) How do I improve my score?

If you are starting off with a less than desirable score, don't stress. Many of you may recall my post-college "Summer of Fun" that ended with a $4000 credit card bill, comprised mainly of Coors Light and Mariners tickets. If not, check out my post on eliminating credit card debt here. Two years later, I am debt-free, have improved my credit score by 126 points to date and am now sitting comfortably in the Excellent credit range. It took hard work and dedication, but, if I can do it, so can you. Below are the steps that worked for me and the most important actions that you can take, today, to improve your score.

1. NEVER EVER miss a payment. Paying your bills, on time, every month is the fastest and most surefire way to improve your credit score, as payment history comprises a whopping 35% of your total credit score. In fact, one missed payment can drop your score over 20 points at one time! Payment history includes everything from your electricity and cable bills, to parking tickets, to student loans, to credit cards. The easiest way to prevent missed payments is to set all of your accounts to auto-pay. I like to set a reminder on my phone 3 days prior to the bill due date to ensure that I have enough money in the respective account to cover the charge.

2. Pay your bill, in full, every month. This ensures that you never pay interest or late fees on any of your charges and that you keep your credit utilization rate below the 30% guideline.

3. Unload debt. Only charge what you can afford to pay off, in full, every month. Focus all of your energy and extra cash on getting out of debt. If you want to learn more about this topic, as well as my tips and tricks, read up on my advice here.

4. Monitor and fix errors on your credit report. Remember, your credit report details exactly why you have the credit score that you do. It includes your entire credit history. However, believe it or not, 25% of credit reports contain an error of some kind. You are entitled to one free credit report each year. Review your report in entirety and report any errors or red flags immediately. Removing an old or incorrect account from your credit report could increase your score by over 100 points.

5. Be mindful about closing accounts. A few months ago, a close friend casually shared with me, over dinner, that she was going to close a college credit card, as she loves the miles she earns on her Alaska card and, thus, rarely uses her college credit card. Immediately, warning signals went off in my head. The length of your credit history plays a huge role in your overall credit score. As young people, this is especially challenging. Canceling your accounts, especially your oldest accounts, like those from college, can drop your score, dramatically, overnight. Additionally, closing an account cuts down on your available credit, increasing your credit utilization rate. For example, if you have two credit cards, each with a limit of $5000, and a balance of $4000 on one, closing one account bring your credit utilization rate from a respectable 40%, all the way up to 80%!! While closing an unused account may seem like no big deal, be cautious when doing so. Give serious consideration to how an account closure will affect your length of history and credit utilization rate.

6. Request an increase on your credit limit. While asking for more credit may seem counter-intuitive, if you are serious about getting out of debt and have the willpower not to spend into your increased credit limit, take a page out of Nike's book and "Just Do It." Increasing your credit limit can dramatically increase your score, while you focus on getting out of debt, as it decreases your credit utilization rate. Although you may have the same balance, you have a greater amount of credit available to you, which decreases your credit utilization rate and makes you appear more responsible with managing your credit, both of which contribute to a great credit score.

I'll leave you today with a powerful story from Liz Weston of Your Credit Score. Two women, alike in almost every aspect, both have student-loan debt, carry a credit card balance and earn similar incomes, go to buy a home. One manages credit well, with a score of 750. The other manages credit poorly, with a score of 650. The result is that the woman with the lower score spent $200,000 more over the course of her mortgage. If she had invested that money, she could have retired with an additional 2 MILLION dollars.

Managing your credit score can pay off dividends over the course of your lifetime. I cannot stress enough the importance of understanding and prioritizing the big wins and tenets of personal finance, such as your credit score, over mundane and unfulfilling actions, such as giving up lattes. As always, please reach out with any questions or any tips and tricks that have worked for you. Together, we can achieve the perfect 850 and retire early on the sunny vineyards of Napa with a glass of Merlot in hand. Cheers!

We love answering all of your questions + always answer every email, comment or DM that comes our way! If there’s anything you want to learn more about, don’t hesitate to ask!!